It is important to note at the outset that this article does not constitute an analysis of solutions by Nomios but merely presents the conclusions of Gartner®.

We congratulate our partners Palo Alto Networks, Fortinet, Netskope and Zscaler for their positioning in the 2024 Magic Quadrant™ for Security Service Edge (SSE). Their inclusion in this report demonstrates the strength of our strategic partnership choices, reflecting our commitment to providing high-quality security solutions to our customers.

The Magic Quadrant™ SSE of April 15, 2024, analyzes cloud security solutions to assist buyers in evaluating SSE providers within a Secure Access Service Edge (SASE) strategy framework. These partners stand out for their execution capabilities and market vision.

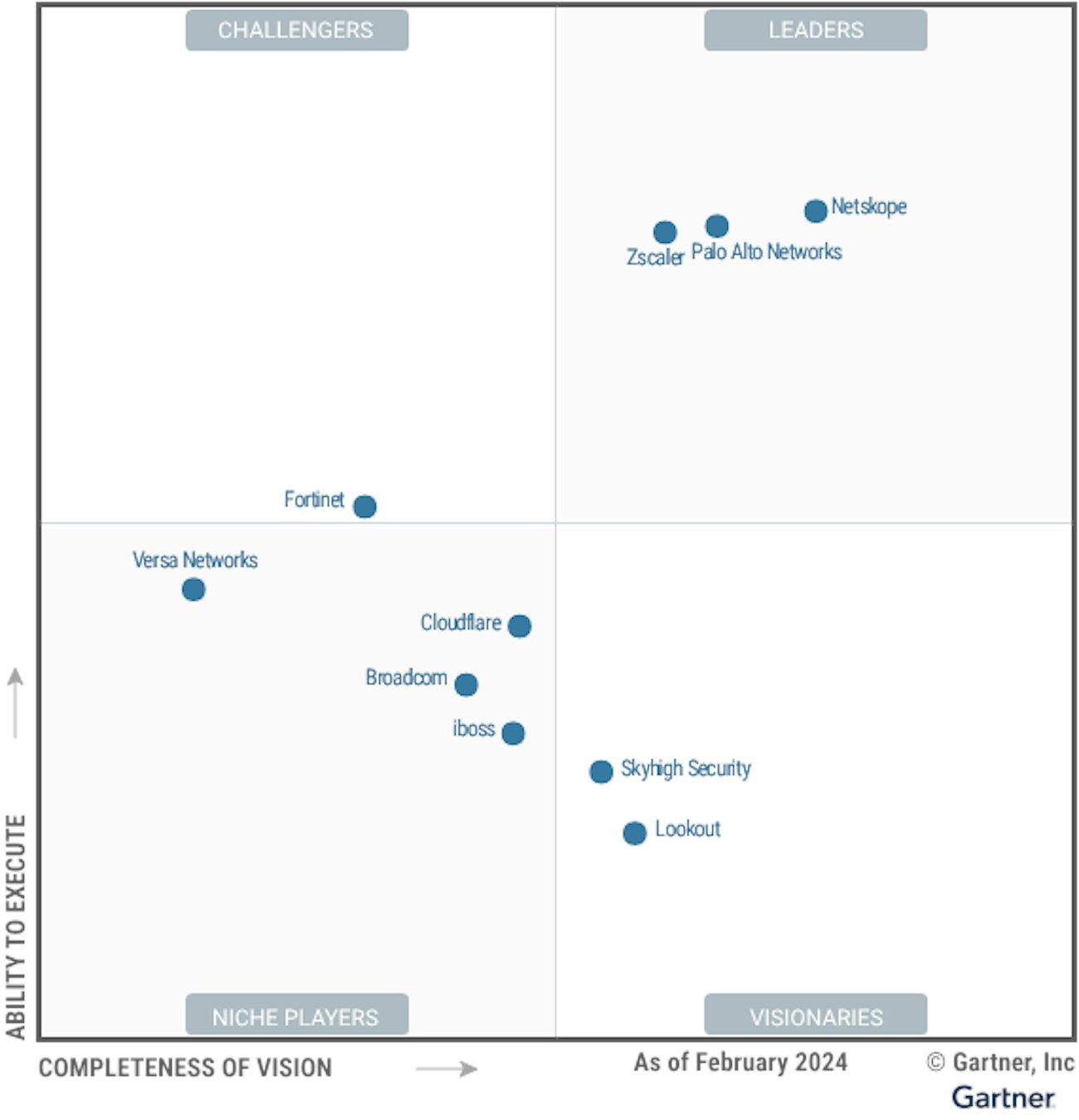

Summary of Gartner® SSE 2024 MQ

The leaders in this Magic Quadrant™ include Palo Alto Networks, Netskope, and Zscaler. Each has strengths and areas for improvement.

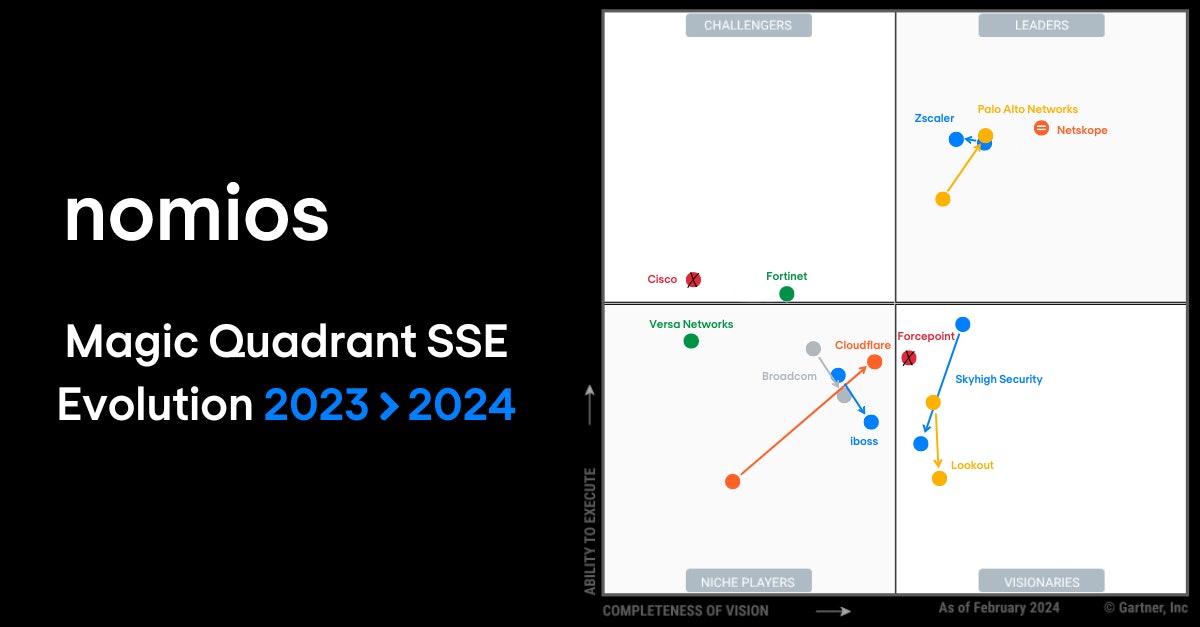

Comparison and evolution between 2023 and 2024

Key points to note

When comparing the Magic Quadrant™ for 2023 with that of 2024, several developments are notable:

- Netskope and Zscaler have managed to maintain their positions as leaders. Netskope is favoured by Gartner® both as the most innovative solution and for its best ability to be delivered.

- Palo Alto Networks transitioned from challenger to leader status between 2022 and 2023, following acquisitions and improvements to its products like Prisma Access. They continue to enhance in 2024 by increasing both their ability to innovate and deliver to join the top group.

- In 2023, Skyhigh Security climbed the ranks to become a visionary in the Magic Quadrant™, thanks to its data-centric security approach and wide range of clients. The company stood out for its efforts to integrate technologies like DLP and RBI, thereby consolidating its position among the visionaries. Gartner® considers that Skyhigh Security is largely focused on government sectors and financial services and has less appeal to clients outside these areas, which may explain their decline in delivery capability.

- Broadcom maintained its position among the niche players in 2024, but its lack of overall integration and disparate consoles could hinder its progress.

- Finally, Fortinet and Versa Networks make their appearance in the SSE Magic Quadrant™, respectively in the Challengers and Niche Players categories.

The Leaders

- Palo Alto Networks offers Prisma Access, a robust SSE solution, and invests in acquisitions like Talon Cyber Security to bolster its capabilities. However, according to Gartner®, some clients find the licensing model complex, and associated costs can be a deterrent.

- Netskope has a strong understanding of the SSE market. Its solution, Netskope Intelligent Security Service Edge, provides robust data security controls. However, according to Gartner®, Netskope can be expensive compared to its competitors and has been slow to introduce certain features like Digital Experience Monitoring (DEM).

Zscaler has a cloud-native approach and a strong marketing strategy. Its solution, Zscaler for Users, offers recognized SSE features. However, according to Gartner®, clients have reported performance and latency issues, and the complex pricing model can create confusion.

The Challengers

Fortinet, with its FortiSASE offering, serves as the sole challenger in this 2024 edition of the SSE Magic Quadrant™. Its varied clients in size and sector benefit from extensive geographical coverage. Fortinet is striving to expand its POP network, notably with Google Cloud, but the POP networks of both brands are not interoperable. Meanwhile, Fortinet continues to work towards better integration of its wide range of security solutions.

The Visionaries

Visionaries like Lookout and Skyhigh Security bring innovative ideas but may have specific limitations:

- Lookout offers robust data security solutions but has fewer Points of Presence (POP) than its competitors. It charges additional costs for certain advanced features.

- Skyhigh Security has a data-centric security approach and a comprehensive range of SSE features. However, Skyhigh has fewer POPs, which can affect its performance and its ability to meet customer expectations.

Niche Players

Among the Niche Players, we find companies like Cloudflare, Broadcom, Versa Networks, and iboss. Each of these companies has strong offerings but identified limitations:

- Cloudflare has a global presence and a simple pricing model but lacks advanced features like content sandboxing.

- Broadcom has significant geographical diversification, but its SSE solution lacks unified consoles and integration. Clients express reservations regarding the user experience.

- Versa Networks enters the Quadrant with its product Versa Security Service Edge, managed through a single and unified console. However, there is a lack of recognition for Versa Networks in the SSE market by clients, and the solution is still catching up on capabilities such as endpoint detection and response, typically already available among competitors.

- iboss offers a web-focused SSE solution but with limitations in API integration for SaaS applications.

Exiting the SSE Magic Quadrant™

Two of our partners have been excluded from this ranking as of October 15, 2023. The truth of October is probably different from the truth of April 2024, but we are confident in their ability to bounce back and quickly return to the ranking.

Here are the reasons for their exclusion by Gartner®.

Cisco

"Cisco Systems was excluded from the Magic Quadrant™ because its main SSE offering, Cisco Secure Access, did not reach the required number of customers and seats by October 15, 2023. Cisco's SSE product is part of several product lines, including Cisco Umbrella, Cisco+ Secure Connect, and Duo. In 2022, Cisco launched its service Cisco+ Secure Connect, which aims to consolidate SSE with elements of Meraki SD-WAN, but only supports 5,000 users. Cisco also expanded its data loss prevention (DLP) capabilities to include EDM and added the ability to apply these capabilities across multiple channels, such as the cloud access security broker (CASB) and the secure web gateway (SWG). Despite this, Cisco failed to meet the criteria for inclusion in the 2024 Magic Quadrant™."

Forcepoint

"Forcepoint was excluded from the Magic Quadrant™ because it did not meet the mobile agent support criterion by October 15, 2023. Forcepoint offers SSE solutions via the Forcepoint ONE platform, which combines various technologies such as DLP, remote browser isolation (RBI), and firewall-as-a-service (FWaaS). Forcepoint has made efforts to streamline its SSE offerings, including migrating customers from its traditional cloud products to Forcepoint ONE. Although Forcepoint has a global presence and diverse customer base, the lack of mobile agent support was the determining factor in its exclusion from the 2024 Magic Quadrant™."

Gartner disclaimers

GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally, Magic Quadrant is a registered trademark of Gartner, Inc. and/or its affiliates and is used herein with permission. All rights reserved.

Gartner, Magic Quadrant for Security Service Edge, By Charlie Winckless, Thomas Lintemuth, Dale Koeppen, 15 April 2024.

Gartner does not endorse any vendor, product or service depicted in its research publications and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner's Research & Advisory organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

Ready to talk?

Are you looking for pricing details, technical information, support or a custom quote? Our team of experts in Basingstoke is ready to assist you.